In the second quarter of 2023, euro area banks expect a further, though more moderate tightening for loans to firms.īanks also reported a further substantial net tightening of credit standards for housing loans in the first quarter of 2023, while the net tightening became less pronounced for consumer credit. The tightening impact of banks’ cost of funds and balance sheet situation on credit standards for loans to firms remained contained and broadly unchanged compared with the previous quarter.

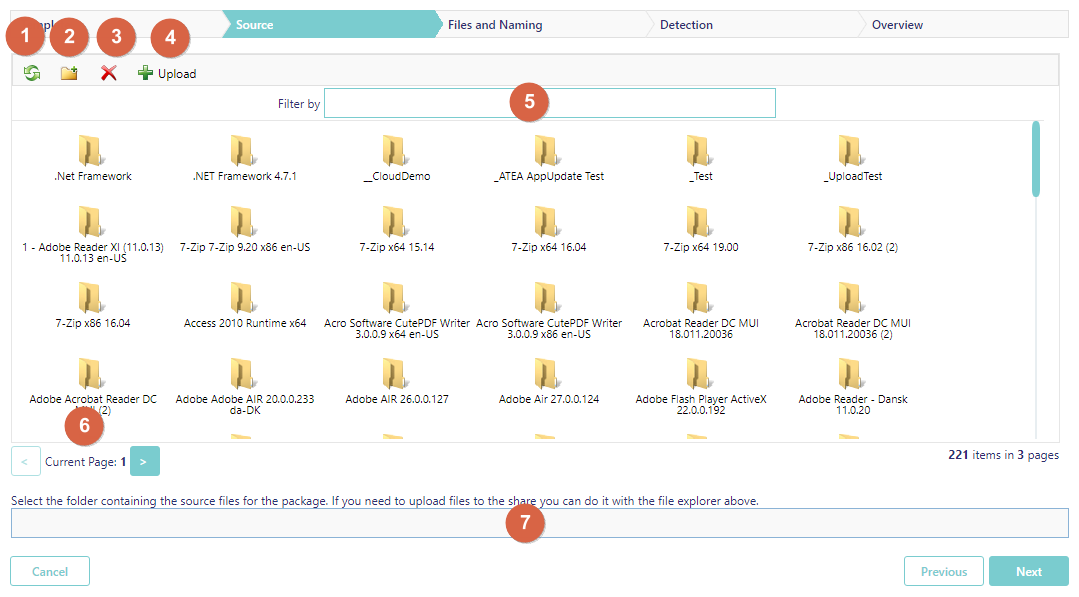

ECB APPLICATION WIZARD DRIVER

Risks related to the economic outlook and firm-specific situation remained the main driver of the tightening of credit standards, while banks’ lower risk tolerance also contributed. The tightening was stronger than banks had expected in the previous quarter and points to a persistent weakening of loan dynamics. From a historical perspective, the pace of net tightening in credit standards remained at the highest level since the euro area sovereign debt crisis in 2011. In the April 2023 BLS, euro area banks indicated that their credit standards for loans or credit lines to enterprises tightened further substantially in the first quarter of 2023. They address the impact of the situation in financial markets on banks’ access to retail and wholesale funding, the impact of the ECB’s monetary policy asset portfolio and TLTRO III on banks and their lending policies, and the impact of ECB key interest rate decisions on bank profitability. Ī number of ad hoc questions were included in the April 2023 survey. In addition to results for the euro area as a whole, this report also contains results for the four largest euro area countries. In the first quarter of 2023, the size of the sample was increased to 158 banks, reflecting mainly the enlargement of the euro area to include Croatia on 1 January 2023. The survey was conducted between 22 March and 6 April 2023. The results reported in the April 2023 bank lending survey (BLS) relate to changes observed during the first quarter of 2023 and expectations for the second quarter of 2023.

0 kommentar(er)

0 kommentar(er)